Unit depreciation calculator

Value of the depreciation per unit. Units of production is a differently worded version of our activity depreciation.

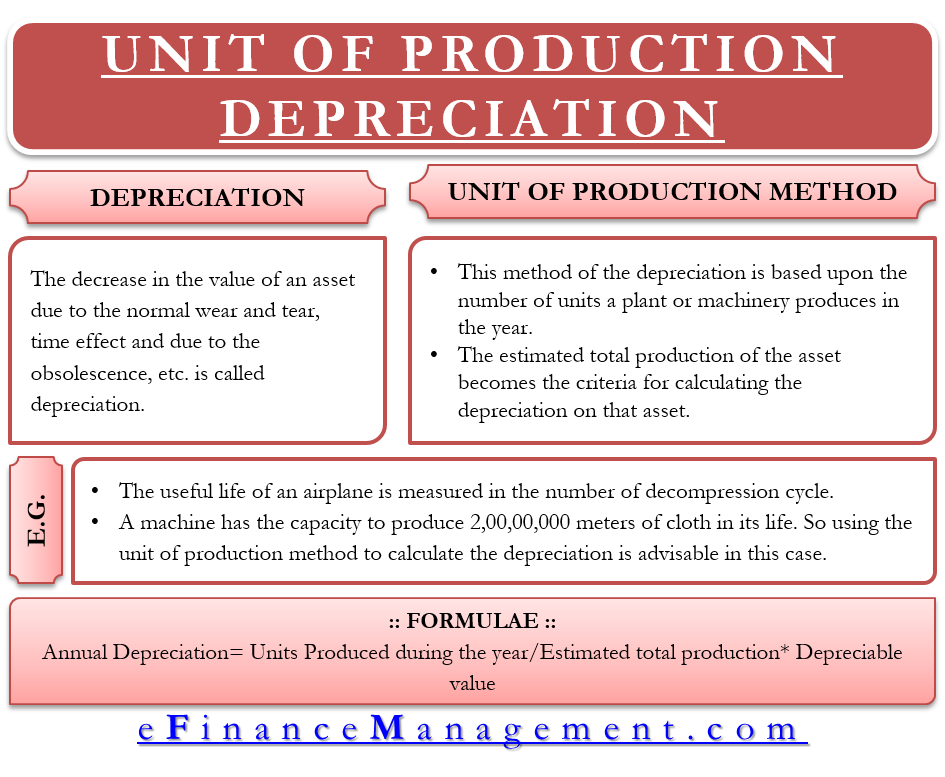

Unit Of Production Depreciation Method Formula Examples

The calculator allows you to use Straight Line Method Declining Balance Method Sum of the Years Digits Method and Reducing Balance Method to calculate depreciation expense.

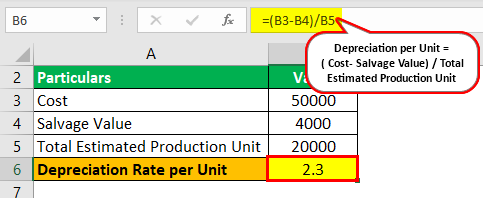

. The given procedure calculates depreciation expense under the digits. If the asset will produce 200 units in its first year period the units of production depreciation value will be the 8000 20000 - 4000 400 200. Use this calculator to calculate depreciation based on level of production for each period.

This depreciation calculator is for calculating the depreciation schedule of an asset. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click Calculate. Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of.

Percentage Declining Balance Depreciation Calculator. Enter the value that you want to calculate depreciation. Depreciation amount 5000 x 20 1000 Decreasing Balances Method The netbook value per year is taken as a basis not the purchase.

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. Straight Line Depreciation Calculator Reducing Balance Method Depreciation Calculator. The depreciation rate 15 02 20.

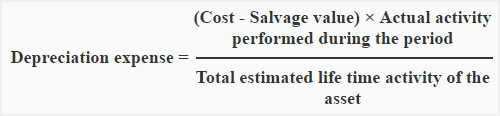

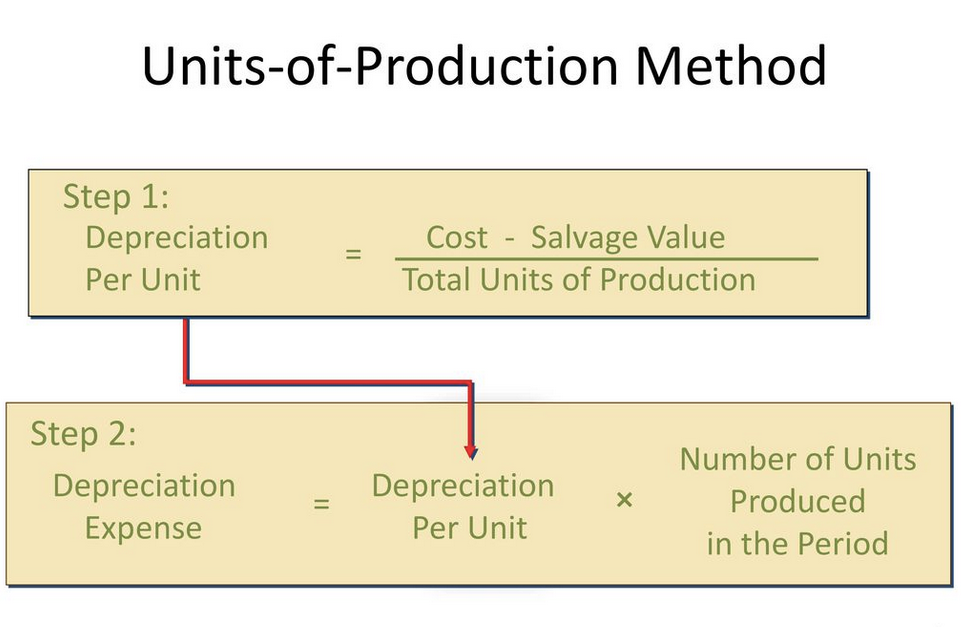

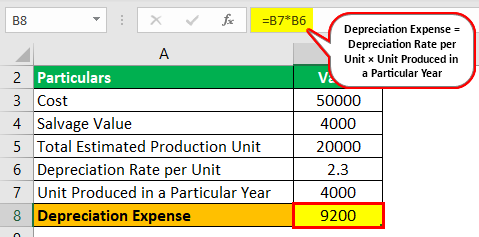

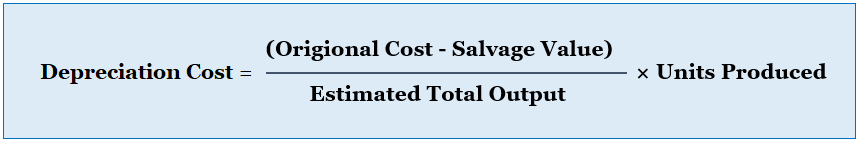

Depreciation expense depreciable cost per unit x units of production during the period Depreciable cost per unit depreciable cost estimated units of useful life Depreciable cost. The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices. First one can choose the straight line method of.

950 Relative depreciation per each period. While the estimated salvage value at the end of its life will be 20000. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

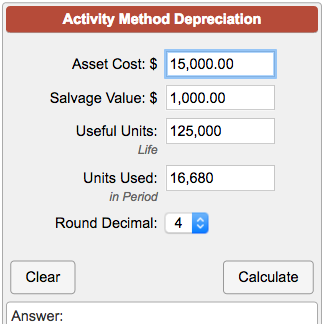

Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. What is activity method of depreciation. This calculator uses the units-of-production UOP depreciation method to compute both the depreciation per unit and total annual depreciation for an item given the items original.

It provides a couple different methods of depreciation. In accountancy this approach assumes that the depreciation. The estimated production capability at the time of purchase for.

At that time installation and purchase cost is 500000. The tool includes updates to reflect tax depreciation. We can calculate the accelerated depreciation by the sum of years digits method using this method.

For example if you have an asset.

Unit Of Production Depreciation Method Formula Examples

Units Of Production Depreciation Calculator Efinancemanagement

Depreciation Formula Calculate Depreciation Expense

Calculating Depreciation Unit Of Production Method

Unit Of Production Depreciation Efinancemanagement

Depreciation Calculator

Depreciation Calculator Shop 58 Off Www Wtashows Com

Depreciation Formula Calculate Depreciation Expense

Unit Of Production Depreciation Method Formula Examples

How To Calculate Depreciation Expense Using Units Of Production Method Wikiaccounting

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

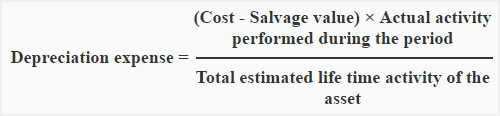

Activity Method Of Depreciation Explanation Formula Examples Accounting For Management

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub